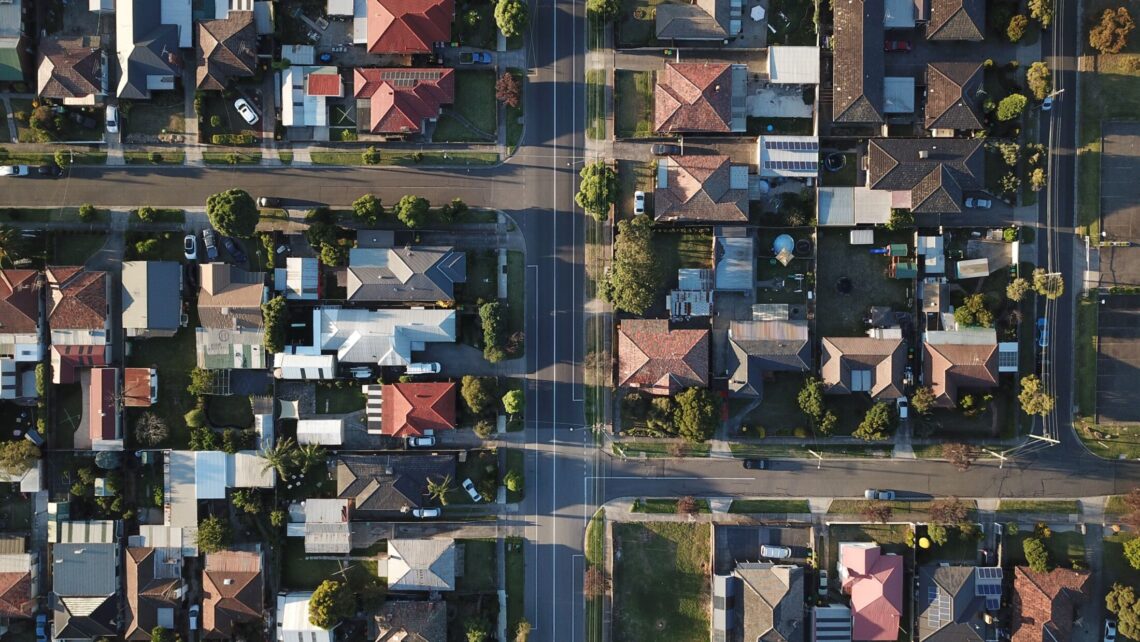

Property prices are expected to stage a full recovery from the 2022 downturn by the end of the next financial year.

Property prices are expected to stage a full recovery from the 2022 downturn by the end of the next financial year.

A new report by Domain has suggested that the country’s housing market will be in a “well-established, steady recovery” over the 2023–24 financial year.

The Domain Forecast Report tipped that house prices in Sydney, Adelaide, and Perth will hit record highs in that period, while unit prices in Brisbane, Adelaide, and Hobart could also “smash” existing records.

“We’ve already started to see prices rising this year and we’re expecting that to continue, but we’re expecting the recovery to be slow and steady,” Domain chief of research and economics Dr Nicola Powell said.

“Sydney is set to be the one outperformer with the strongest rate of growth, but there will be a lot of different dynamics going on with both push and pull factors, which can have very different impacts.”

Dr Powell noted that the biggest factors driving growth will be the continuing lack of supply of homes on the market and the rise in population on the back of a predicted boost in migrant numbers.

Domain’s report is based on the expectation that interest rate hikes are close to an end, adding an upward boost to the market.

It did, however, flag that the number of people facing the cliff’s edge of variable rate rises after their fixed rates expire will act as downward pressure on prices.

Conversely, Domain noted, if interest rates start to come down from early 2024 in line with market expectations, borrowing/buying power could increase, exerting more upward price pressures on the housing market.

“Affordability will eventually contain the rate of growth with people able to borrow less and being unnerved by higher inflation,” Dr Powell said. “So, while it won’t be smooth sailing, the outlook is much more optimistic.”

Source: Property prices tipped to stage ‘full recovery’ in 2023-24, Maja Garaca Djurdjevic for Investor Daily