Australian house prices are on the way up, moving into neutral or positive territory for the first time since Covid-19 hit.

First home buyers are driving the demand for houses, lured onto the market by low interest rates, tax cuts and changing preferences for post-lockdown living, according to the latest quarterly report from Domain.

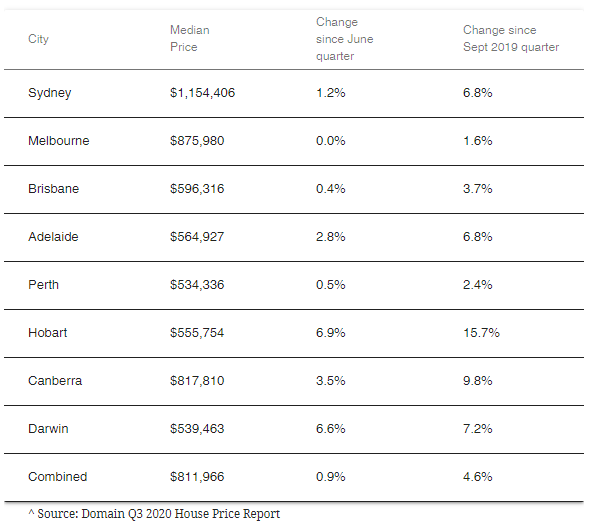

House prices went up by 0.9 per cent in the September quarter and 4.6 per cent in the year across capital city markets.

This is great improvement across the country compared to the June quarter, where prices dropped 2 per cent for houses and 2.2 per cent for units following a small increase earlier in the year.

House prices: September quarter

Domain senior research analyst Nicola Powell said first home buyers are driving the market while investment activity stalls.

“Consumer confidence has made a remarkable rebound, boosted by the federal budget, success in containing the corona virus and the prospect of further interest rate cuts,” Powell said.

“Strong buyer demand has absorbed rapidly rising new supply. With fewer investors and foreign interest, first-home buyers are taking advantage of the reduced competition, government incentives and low mortgage rates.

“With high vacancy rates, weak gross rental yields and fewer opportunities for capital gains, it may be some time before investors return.”

Powell said government initiatives have stalled distressed sales keeping the market intact for now.

“While there is currently no evidence of an increase in distressed selling, the risks increase once financial support is removed,” Powell said, adding that demand will also take a hit as overseas migration collapses.

“The proposed relaxing of lending standards early next year and the imminent prospect of an interest rate cut will encourage people to borrow.

“However, with less scrutiny placed on borrowers it will become easier to take out a mortgage, making access to credit simpler and quicker – this is likely to boost demand for housing and, in turn, support home values.”

Source: First Home Buyers Drive House Prices Up, by Renee McKeown, The Urban Developer